Belgium drops two places in ManpowerGroup’s 2024 Total Workforce Index™ and ranks 52nd out of 64

Economic Uncertainties Continue to Impact Employers’ Hiring Plans in Belgium

10 September 2024

2023-2024 Belgium ESG Report : Working to Change the World

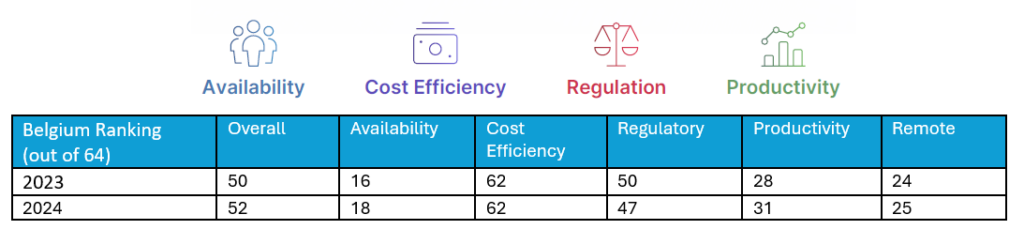

14 November 2024ManpowerGroup has published the eleventh edition of its Global Workforce Index™. Like the Gross Domestic Product (GDP) is used as an indicator to measure the performance of economies, ManpowerGroup’s Total Workforce Index (TWI) measures the appeal of a country’s labour market based on more than 200 key criteria divided into 4 categories: Workforce Availability, Cost Efficiency, Regulation, and Workforce Productivity. For 2024, Belgium stands in 52nd place (out of 64) in this ranking at global level and 27th place (out of 33) in the EMEA region (Europe, Middle East, Africa). This represents a drop of 2 places at global level and a status quo at regional level.

In a year marked by unprecedented technological leaps, geopolitical upheaval, and an increasing focus on sustainability, ManpowerGroup’s annual Total Workforce Index™ (TWI) reveals a shifting and competitive global talent landscape. The TWI, which compares the conditions for hiring, managing, and retaining talent (fixed and flexible) in 64 global labour markets by assessing more than 200 factors, has introduced new measures for artificial intelligence (AI), sustainability, peace, and stability, which have significantly impacted this year’s rankings. While the United States, Singapore, and Canada retain the top three spots for the fourth consecutive year, these new metrics have reshaped the competitive global workforce environment. At European level, the top three places are occupied by Ireland, the United Kingdom and Switzerland.

Notable changes in the world rankings include the Arab Emirates moving up to 7th place from 22nd in 2022, China 10th) entering into the top 10 for the first time, India (34th) moving up 11 places, and Israel dropping 9 places to 14th. The report also highlights the progress made by countries on the 4 criteria studied, reflecting advances in labour market participation, innovation, the transition to a greener economy, education, as well as flexibility, the regulatory framework and labour costs.

Belgium ranks 52nd out of 64 countries globally

Compared with other European countries, Belgium’s 52nd place in the world is well behind Ireland (5th), the United Kingdom (6th), Switzerland (8th, up 2 places), the Netherlands (15th), Portugal (26th, up 3 places), Sweden (27th), Germany (36th, up 6 places), France (39th, up 4 places), Luxembourg (40th, up 6 places), Poland (41st), and Spain (51st). Only five European job markets are less attractive than Belgium: Greece (53rd), Serbia (54th), Slovakia (56th), Italy (57th) and Turkey (59th).

“At a time when the job market is under pressure due to economic uncertainties(1), the new edition of our Total Workforce Index highlights our country’s structural weaknesses,” says Sébastien Delfosse, Managing Director of ManpowerGroup BeLux. “Belgium’s appeal has been severely affected by its 62nd position out of 64 in terms of labour costs, at a time when competition to attract investors is continually increasing between countries within Europe, as well as at global level – between Europe, the United States, and China. Belgium’s traditional strengths, such as the quality of its workforce and its productivity, cannot compensate for its poor performance in terms of labour costs, employment rates and an overly rigid regulatory framework. This represents a real threat to our industry and the prosperity of our country, at a time when economies are transforming at an accelerated pace. There is an urgent need to reduce the cost of labour and to show greater ambition in tackling tomorrow’s challenges.”

Belgium’s strengths and weaknesses

Belgium stands out for its divergent scores on the 4 criteria studied: it occupies a good 18th place worldwide for the criterion of availability of talent (down 2 places). For Productivity, our country is still in the top half of the table, standing in 31St place (down 3 places). On the other hand, Belgium is still clearly lagging behind in terms of its regulatory framework, which is considered too rigid, as confirmed by its 47th place (up 3 places), whilst it ranks 62nd alongside France in terms of labor costs (unchanged), with Austria occupying the last position on this criterion.

Belgium is 25th on the teleworking criterion. This criterion assesses the various dimensions of teleworking, such as the number of people able to work remotely, access to technology and the performance of communication tools, control of cybersecurity risks, the performance of government online services, regulatory aspects, and the human dimension (access to childcare services). “It’s a good performance on a global scale, but here too we’re a long way behind the Grand Duchy of Luxembourg (4th), the Netherlands (5th), the UK (12th), and France (13th),” adds Sébastien Delfosse.

Among Belgium’s strengths, the ManpowerGroup report highlights the quality of our workforce, with 49% highly skilled workers and 60% proficiency in English. It is also worth noting our country’s tenth place on the gender equality criterion (out of 146 countries). Belgium also ranks 15th (out of 132 countries) on the Global Innovation Index, which reveals the most innovative economies based on 80 criteria, and 12th (out of 160) on the Global Green Economy Index™ (GGEI), which measures sustainability performance based on 18 criteria.

Key challenges facing global labour markets

In its global report, ManpowerGroup identifies 4 major challenges facing labour markets worldwide:

- Technological disruption: Automation, generative AI and digital transformation are reshaping industries, and markets that fail to invest in innovation and technology infrastructure tend to underperform in the TWI. Against this backdrop, companies need to adopt strategies to support talent attraction, skills development, and the integration of new tools.

- Ongoing talent shortages: The TWI indicators on workforce availability and access to sustainable talent pools highlight the impact of talent shortages and demographic shifts on employer decisions. Companies are seeking solutions that ensure a steady pipeline of skilled workers through targeted recruitment, development, and retention efforts.

- Persistent economic and geopolitical risks: Factors such as inflation, tax burdens, wage pressures, currency volatility, and political instability significantly influence workforce investments as organizations develop strategies to mitigate risks, reduce costs, and invest in sustainable workforces and environments. This includes adjusting location strategies and managing financial risks to maintain operational stability.

- Evolving workforce metrics: To respond to developments related to artificial intelligence and the search for a sustainable future, companies need flexible strategies that adapt to meet new needs. To remain competitive, companies will need to assess their performance based on up-to-date, refreshed metrics. In particular, this means focusing on developing skills in AI and sustainability to meet future requirements.

A strategic tool

The Total Workforce Index enables the ManpowerGroup Talent Solutions division to help companies with their strategic decisions, by objectively identifying the most favourable conditions for managing their talent. This may involve the development of resource planning, investment programmes, expansion, mergers and acquisitions, or the implementation of new organizational models or cost reduction programmes.

****

(1) ManpowerGroup Employment Barometer Q4 2024

For more information : visit our TWI website

Market Profile Belgium

Total Workforce Index Report

About Total Workforce Index™

ManpowerGroup Total Workforce Index™ (TWI) is an indicator of workforce potential in a specific market. It is based on a rigorous methodology and on a unique calculation formula that allows the analysis of more than 200 criteria related to 4 categories: Workforce Supply, Cost Efficiency, Regulation, and Workforce Productivity. It concerns information published by international organizations such as the World Bank, the OECD, and the World Economic Forum, and data collected by ManpowerGroup globally. In concrete terms, the Total Workforce Index measures the attractiveness of the labour markets of 63 countries around the world, by analyzing the relative ease of sourcing, hiring, developing, and retaining the talents they need to ensure their growth. The country with the highest score on this index is the one with the most attractive labour market.

- Workforce Availability measures the relative comparison of the current skilled workforce andlikely sustainability of that workforce based on demographic trends, such as age and influx of immigrants. Markets Markets scoring favorably in the Availability category have high availability of skilled workers, labor force participation, gender participation, remote work capabilities and access to remote talent.

- Cost Efficiency measures the relative comparison ofof wage, benefits, tax and operations metrics to suggest potential opportunities to maximize overall cost.

- Regulation measures the relative comparison of how restrictive the terms and practices of workforce engagement are based on a standard set of regulations.

- The Productivity category measures the relative potential productivity of a workforce based on the number of hours an employer can compensate a worker at base pay.