76% of Belgian employers have difficulties filling their vacancies while they expect to slow down the hiring pace in the third quarter of 2022

ManpowerGroup Study “the Great Realizationt”– World of Work: the Paradigm Shift

29 April 2022

Strong hiring outlook for the fourth quarter in Belgium amid uncertainty and talent shortages

13 September 2022In a rapidly changing job market, IT and digital profiles have become the most sought-after profiles

According to the ManpowerGroup Employment Survey released today, labour market activity will remain strong in the third quarter of 2022 in Belgium. According to the survey from April, in which 520 employers were surveyed(1), 41% of employers plan to increase their workforce by the end of September 2022, while 16% expect to make staff redundant and 39% of the surveyed employers expect no change. After seasonal adjustment, the Net Employment Outlook(2) – or the difference between the percentage of employers anticipating hires and the percentage of anticipating layoffs – ended at a very positive value of +25%. This is a decrease of nine points compared to the previous quarter, but an increase of eleven points compared to the third quarter of 2021. For this edition, ManpowerGroup also conducted its annual talent shortage survey. More than three in four Belgian employers (76%) are experiencing difficulties filling their vacancies, with one in five saying they have great difficulty finding the right profiles. This is a decrease of 7 points compared to last year.

“In a context of increased uncertainty and generally rising costs, Belgian employers expect to hire less quickly in the next quarter, even though they continue to report very favourable hiring intentions in all three regions of the country and in all ten sectors surveyed,” says Sébastien Delfosse, Managing Director of ManpowerGroup BeLux. “As the labour market continues to change at an accelerating pace in many areas – demographics and the retirement of boomers, pressure on skills due to digitalisation, evolving expectations of employees in the post-Covid world and new challenges for organisations – employers worldwide are facing an unprecedented talent crisis. With three out of four employers affected by this crisis, Belgium is in line with the global average. We have been aware of this talent shortage for a long time now but recently, it has become even more acute. All labour market actors should mobilise and develop their action plan to improve talent management, both in the short and long term, in order to reduce the skills mismatch and to create a more sustainable labour market.”

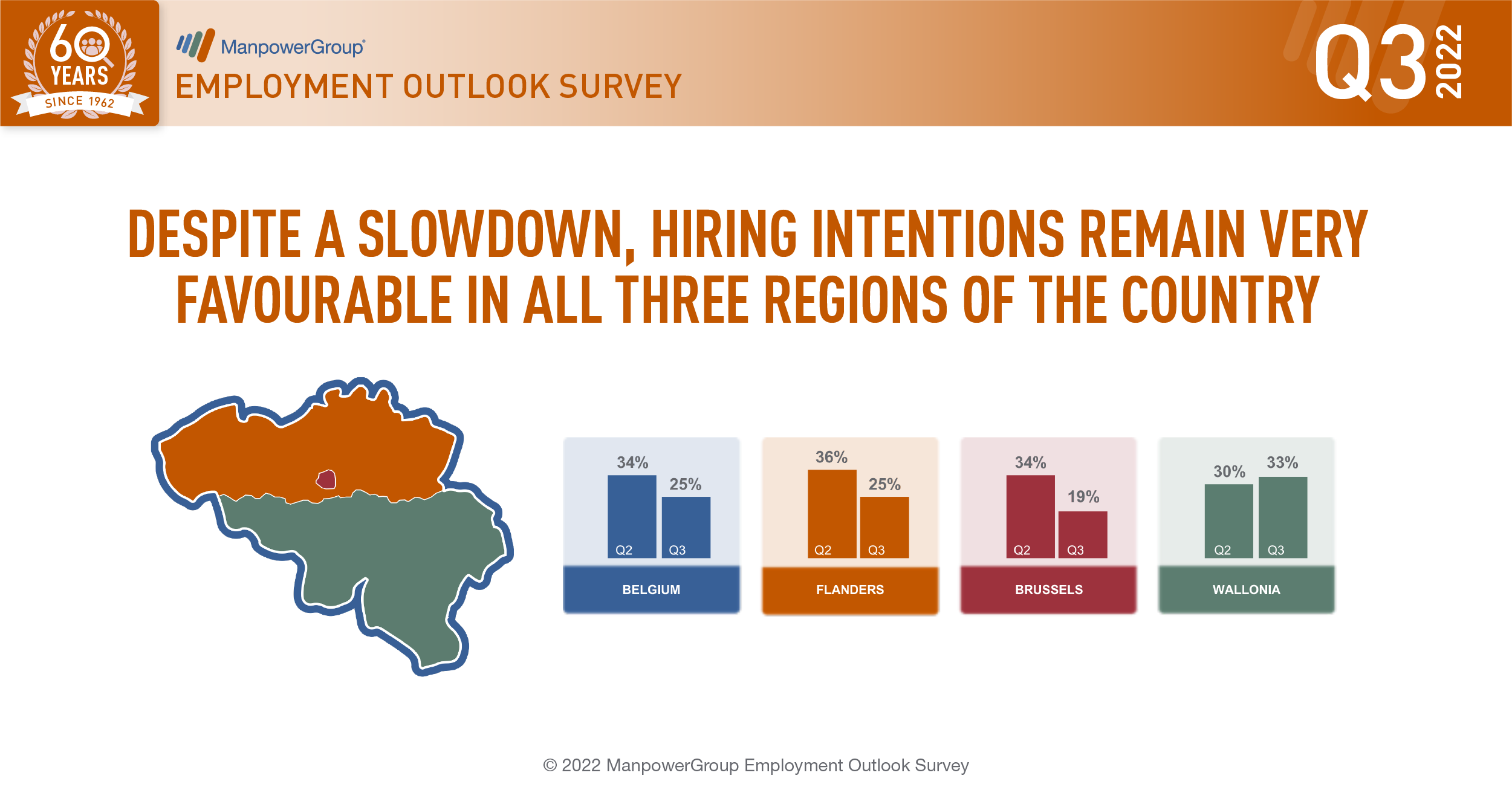

Job creation and recruitment difficulties across the three regions

Employers across the three regions of the country still report very optimistic hiring intentions: +33% in Wallonia, +25% in Flanders and +19% in Brussels.

At the same time, employers in the three regions still struggle to fill their vacancies: 77% face a talent shortage in Brussels, 75% in Flanders (of which 23% say they have ‘great recruitment difficulties’) and 74% in Wallonia. “Each region faces specific problems, but in all of them the activity rate must be increased, mobility improved and job-seekers activated in the bottleneck professions,” Sébastien Delfosse adds.

Strong demand from IT sectors and for digital jobs

Employers in all ten sectors surveyed expect to create new jobs by the end of September, even though nine of the sectors report a decline in job prospects compared to the previous quarter. Employers in the ‘IT, Technology, Telecommunications, Communication & Media’ sector (+47%) and the ‘Wholesale & Retail/Supply Chain & Logistics’ sector (+35%) are the most optimistic. The employment outlook is also very positive in the ‘Public services, health, education and social work’ sector (+25%) and in the ‘Finance, Banking, Insurance and Real Estate’ sector (+24%), as well as in the Restaurants & Hotels, Culture and leisure sector (+23%), which is an encouraging sign.

No sector is spared from a talent shortage. In a changing world of work, it is IT and digital profiles that are the most sought-after. Not only do 86% of the employers surveyed in this sector have difficulty recruiting staff, but according to all employers in all sectors, digital jobs are the profiles that are the hardest to find. Recruitment difficulties are particularly acute in the ‘ Wholesale & Retail Trade/Supply Chain & Logistics’ sector (81%), while the ‘Other Business Services’ sector (81%) calls for specialists in all fields, whether legal, technical, scientific or administrative. There is also a talent shortage in the ‘Public Services, Health Care, Education and Social Work’ sector (+75%) and in the ‘Restaurants and Hotels /Culture & Leisure’ sector (+73%), which is struggling to rebuild its workforce in the wake of the Covid pandemic. The sectors Construction (73%) and Manufacturing (72%) continue to face a structural shortage of qualified workers, while the Finance, Banking, Insurance and Real Estate sector (69%) is also struggling to attract talent.

In the light of this finding, Sébastien Delfosse recommends “improving the attractiveness of jobs in shortages and the quality of training and upskilling “, while companies should emphasize “retaining staff and implementing an individualised HR policy that takes the new expectations of employees into account”.

Recruitment difficulties increase with the size of the company

According to the ManpowerGroup survey, recruitment intentions for the next quarter are positive in all four business segments. Although all companies suffer from labour shortages, it is clear that the recruitment difficulties increase with the size of the company: + 69% for micro enterprises (< 10 employees), +73% for small enterprises (10-49 employees), +78% for medium-sized enterprises (50-249 employees) and +79% for large enterprises (≥ 250 employees).

Soft skills in the post-Covid world: autonomy and responsibility

While employers struggle to find staff due to a lack of available skills (hard skills), recruitment problems are also being felt in terms of personal qualities, with a new trend emerging. Sébastien Delfosse: “Our survey shows an evolution of the soft skills that recruiters are looking for. In the post-Covid world, employers are looking for employees who demonstrate autonomy and responsibility. This makes perfect sense, as these are essential qualities in a working world that promotes hybrid forms of organisation.” The top five soft skills that employers in Belgium rank the most important are (in order): responsibility/discipline, initiative, problem solving, resilience/adaptability, eagerness to learn/curiosity. Soft skills related to cooperation and social life remain important but only come in eighth and ninth place.

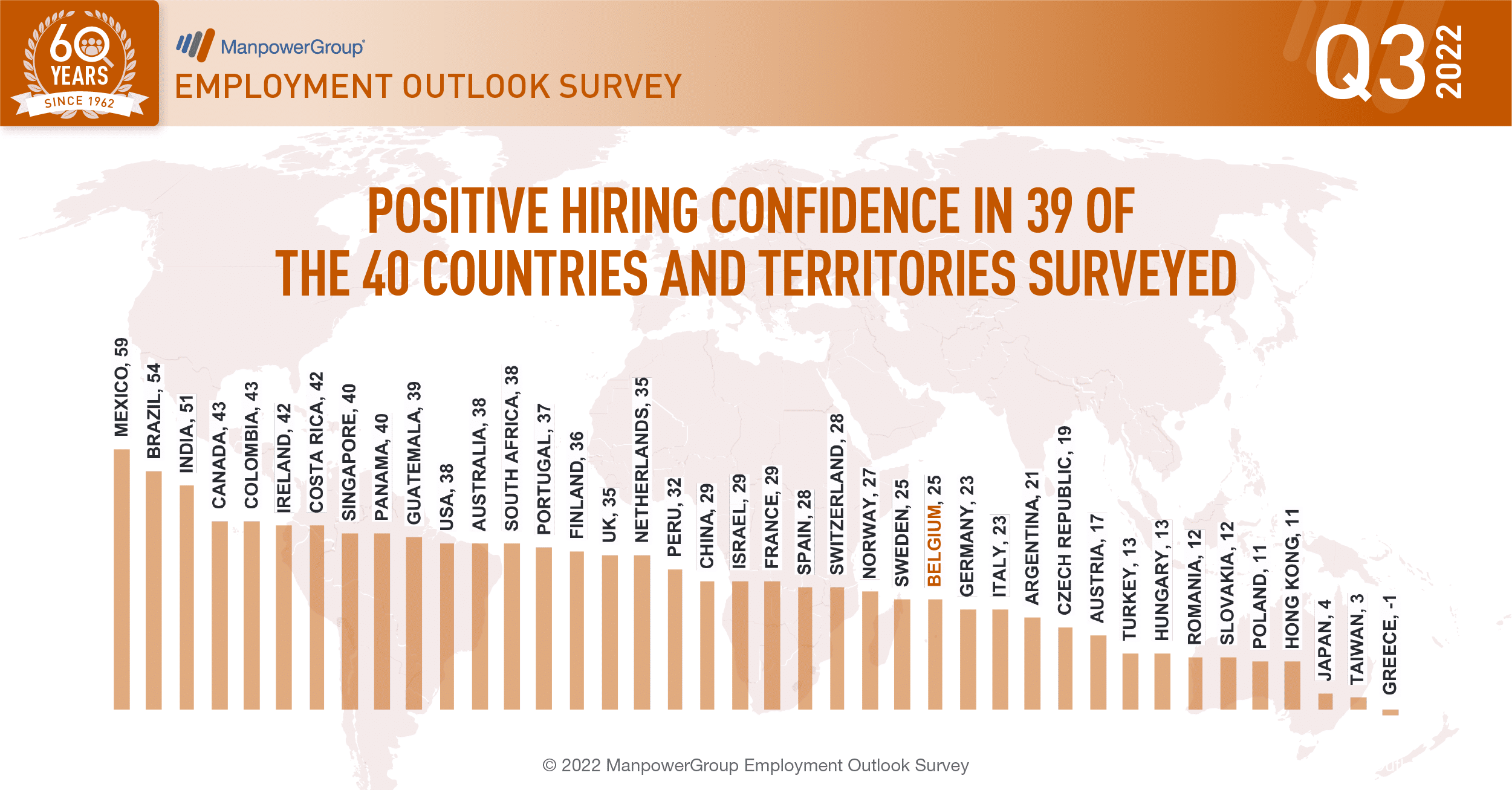

Positive employment prospects in 39 of the 40 countries and territories surveyed

Hiring intentions for Quarter 3 2022 are positive in 39 of the 40 countries and territories surveyed, with only Greece reporting a negative Outlook. At +25%, Belgium’s Net Employment Outlook is At +25%, the Net Employment Outlook for Belgium stands below the global average (+33%) and at the same level as the EMEA average (+25%). In terms of talent shortages, at 76%, Belgium stands at the same level with the global average (75%).

The results of the next ManpowerGroup Employment Outlook Survey will be released on 13 September 2022 (4th quarter 2022).

(1) The ManpowerGroup survey was conducted in April 2022

(2) Throughout this report, we use the term “Net Employment Outlook.” This figure is derived by taking the percentage of employers anticipating an increase in hiring activity and subtracting from this the percentage of employers expecting to see a decrease in employment at their location in the next quarter. The result of this calculation is the Net Employment Outlook. Net Employment Outlooks for countries and territories that have accumulated at least 17 quarters of data are reported in a seasonally adjusted format unless otherwise stated. Seasonally adjusted data are not available for Croatia.

Report : ManpowerGroup Employment Outlook Survey – Talent Shortage Survey