Robust hiring intentions for the first quarter of 2025 in Belgium, despite continued uncertainty at the start of 2025

2023-2024 Belgium ESG Report : Working to Change the World

14 November 2024ManpowerGroup BeLux has been awarded an ‘EcoVadis Platinum’ Medal for its sustainability performance

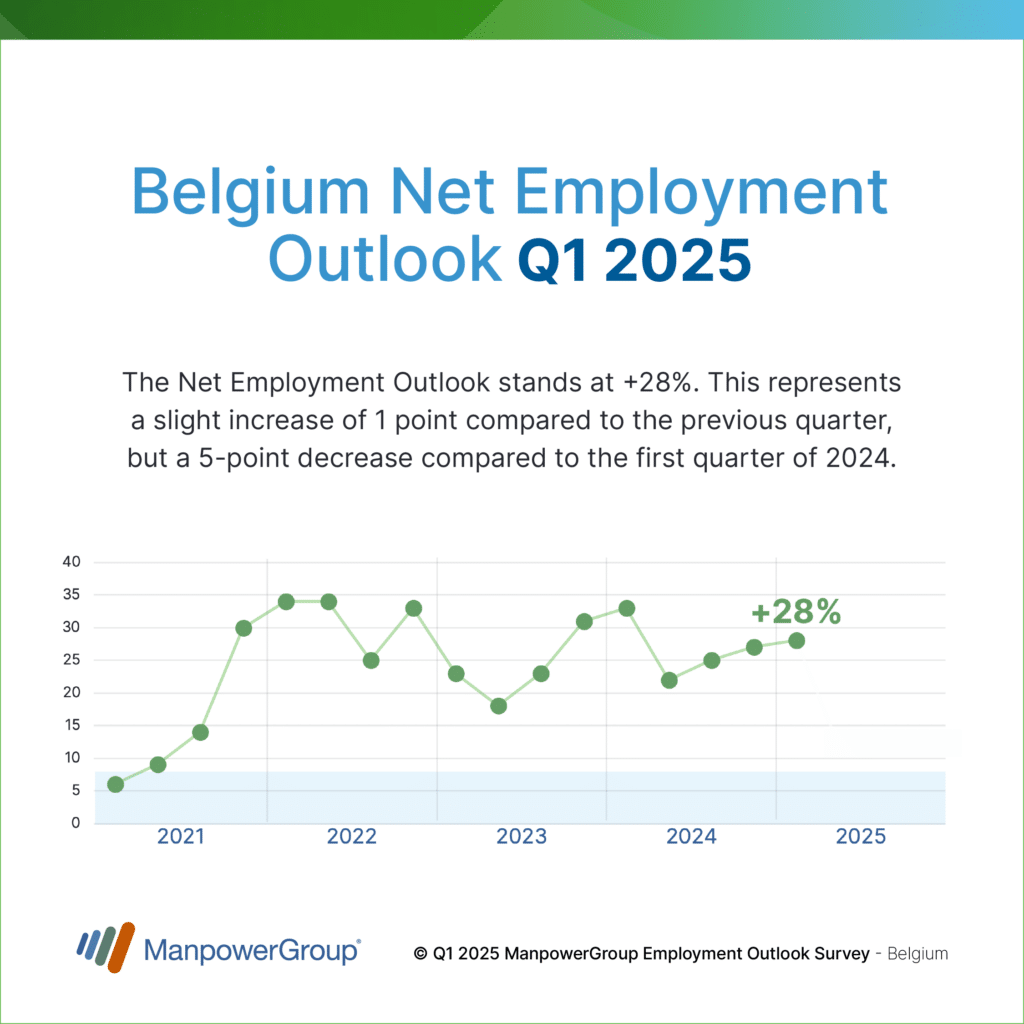

15 January 2025The Net Employment Outlook for the first quarter stands at +28%, up 1 point compared to the previous quarter, but down 5 points year-over-year.

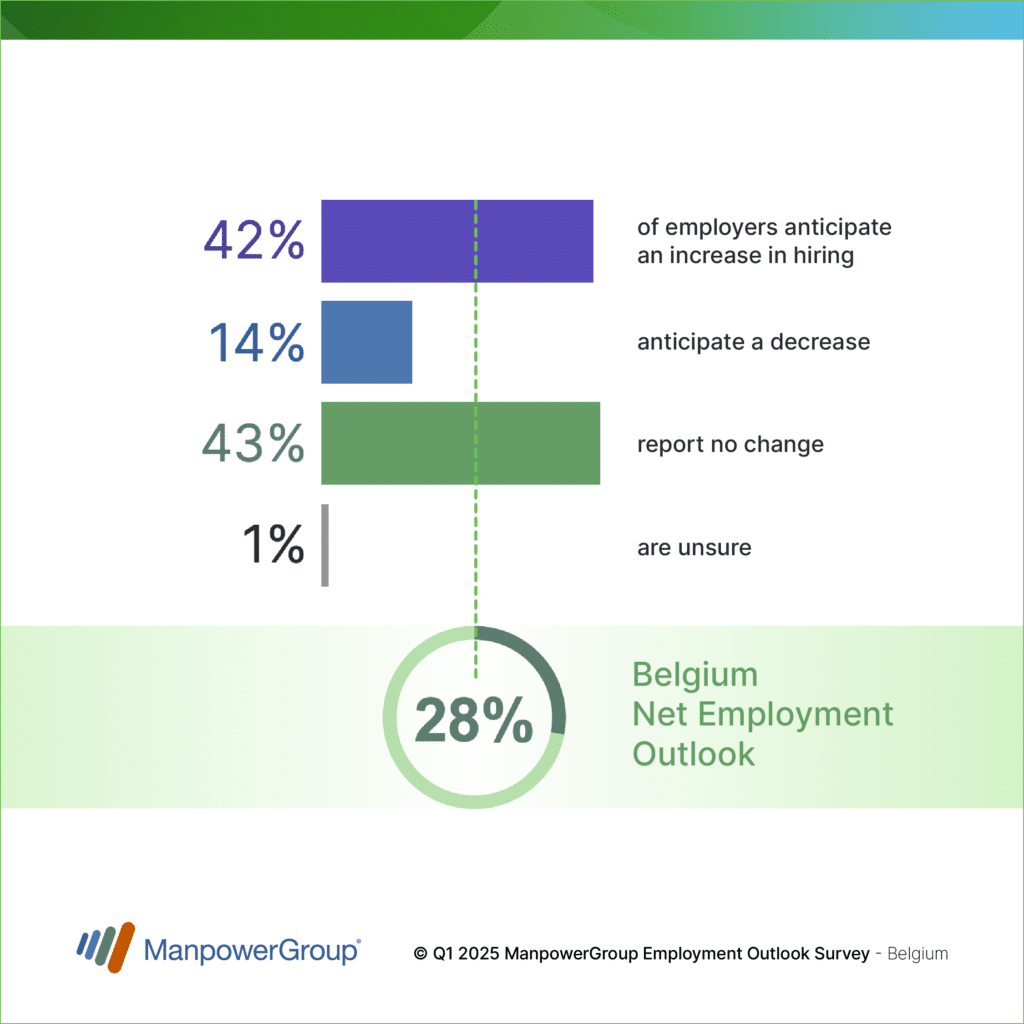

According to the ManpowerGroup Employment Outlook Survey, Belgian employers anticipate positive hiring activity in the first quarter of 2025. Of the 525 employers surveyed by ManpowerGroup in October, 42% plan to increase their workforce by the end of March 2025, while 14% expect to reduce it. Meanwhile, 43% anticipate no changes. After seasonal adjustment, the Net Employment Outlook(1) – the difference between the percentage of employers planning to hire and those expecting to reduce their workforce – stands at +28%.

This represents a minor 1-point increase compared to the previous quarter but a 5-point decrease compared to Q1 2024. Belgium stands 9 points above the EMEA (Europe, Middle East, and Africa) average (+19%), and 3 points above the global average (+25%).

“At the start of 2025, Belgian employers are not expecting to change their hiring pace significantly, despite persistent uncertainty,” said Sébastien Delfosse, Managing Director of ManpowerGroup BeLux. “As highlighted by a recent OECD report(2), our economy has shown resilience, though economic growth is slowing, particularly in the industrial sector. This explains why employers report a positive Net Employment Outlook of +28%, although lower than the same period last year (+33%), with contrasting dynamics across sectors.

Following recent restructuring, dark clouds still hang over the manufacturing sector, which reports the lowest forecasts among all surveyed sectors, reaching its lowest level since Q2 2023. Overall, employment faces long-term pressures due to chronic talent shortages in the labour market, exacerbated by an aging population.”

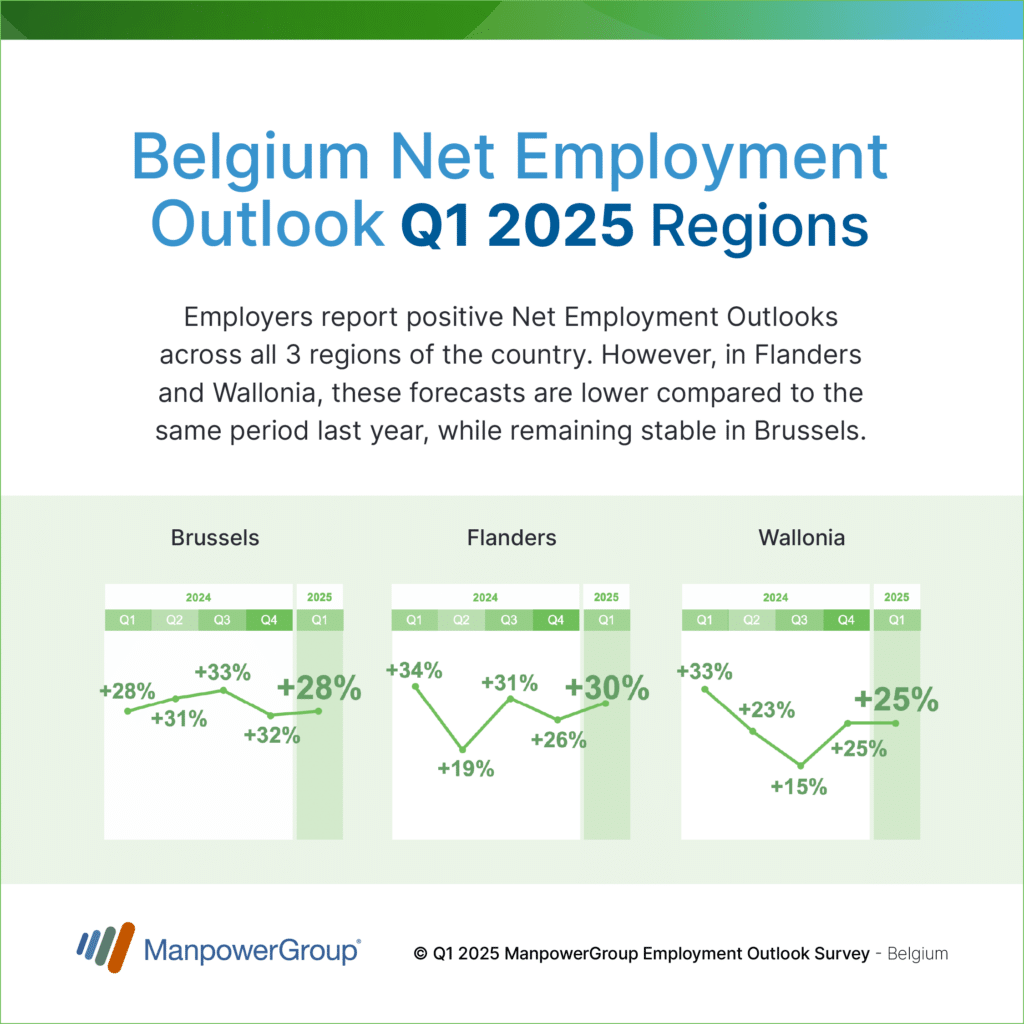

Positive hiring activity across all three regions

Employers report positive Net Employment Outlooks across all three regions of the country: +30% in Flanders, +28% in Brussels, and +25% in Wallonia. However, in Flanders and Wallonia, these forecasts are 4 and 8 points lower, respectively, compared to the same period last year, while remaining stable in Brussels.

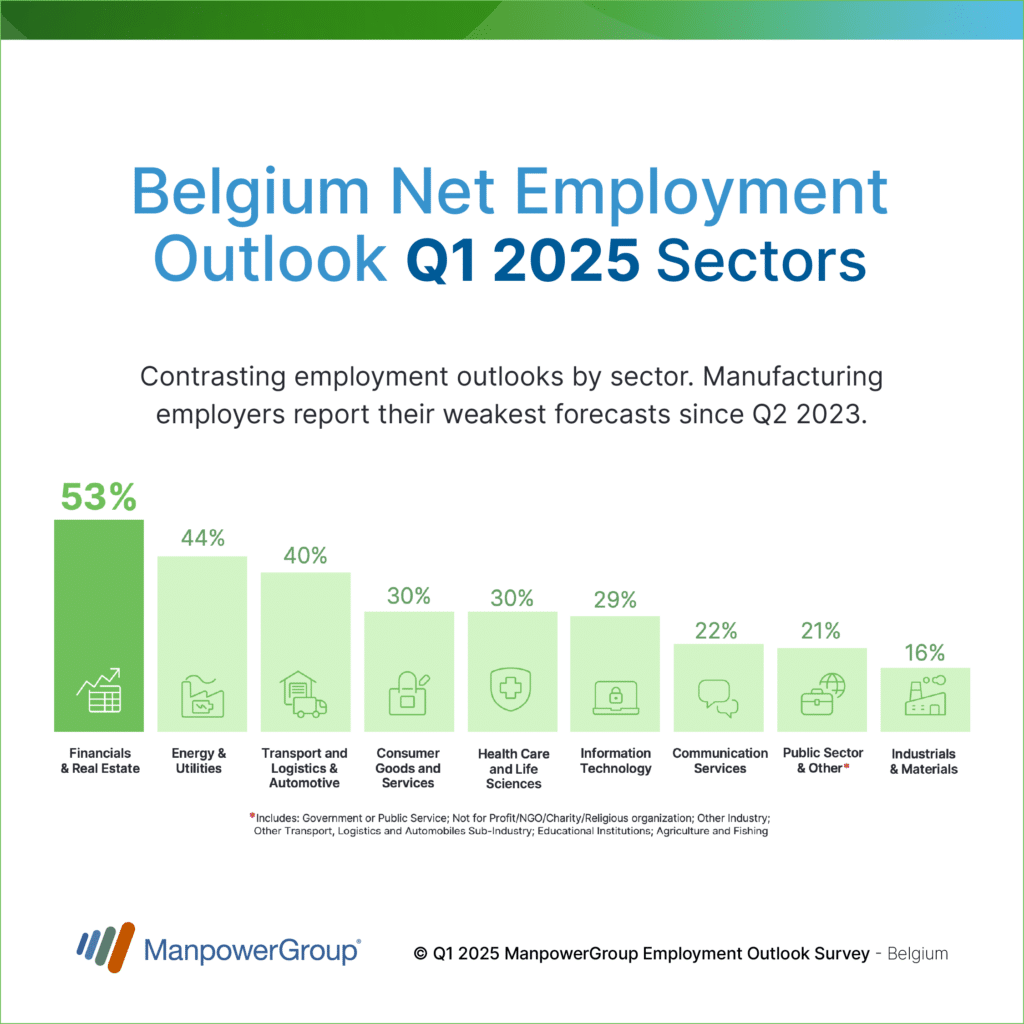

Contrasting employment outlooks by sector

Employers in all nine surveyed sectors in Belgium plan to increase their workforce by the end of March 2025. However, the forecasts vary widely. On the optimistic side, hiring intentions are strong in the Financial and Real Estate sector (+53%), Energy (+44%), and Transport and Logistics (+40%). Conversely, the Manufacturing/Construction/Agriculture& Fishing sector shows very weak forecasts (+16%), down 11 points compared to the previous quarter and 18 points year-over-year. Recruitment activity is expected to remain strong in the Consumer Goods/Horeca/Retail (+30%), Health Care and Life Sciences (+30%), and IT (+29%) sectors.

Employers in medium-sized companies (10 to 49 employees) report the most optimistic forecasts (+39%), while small businesses with fewer than 10 employees show a much more pessimistic outlook (+6%).

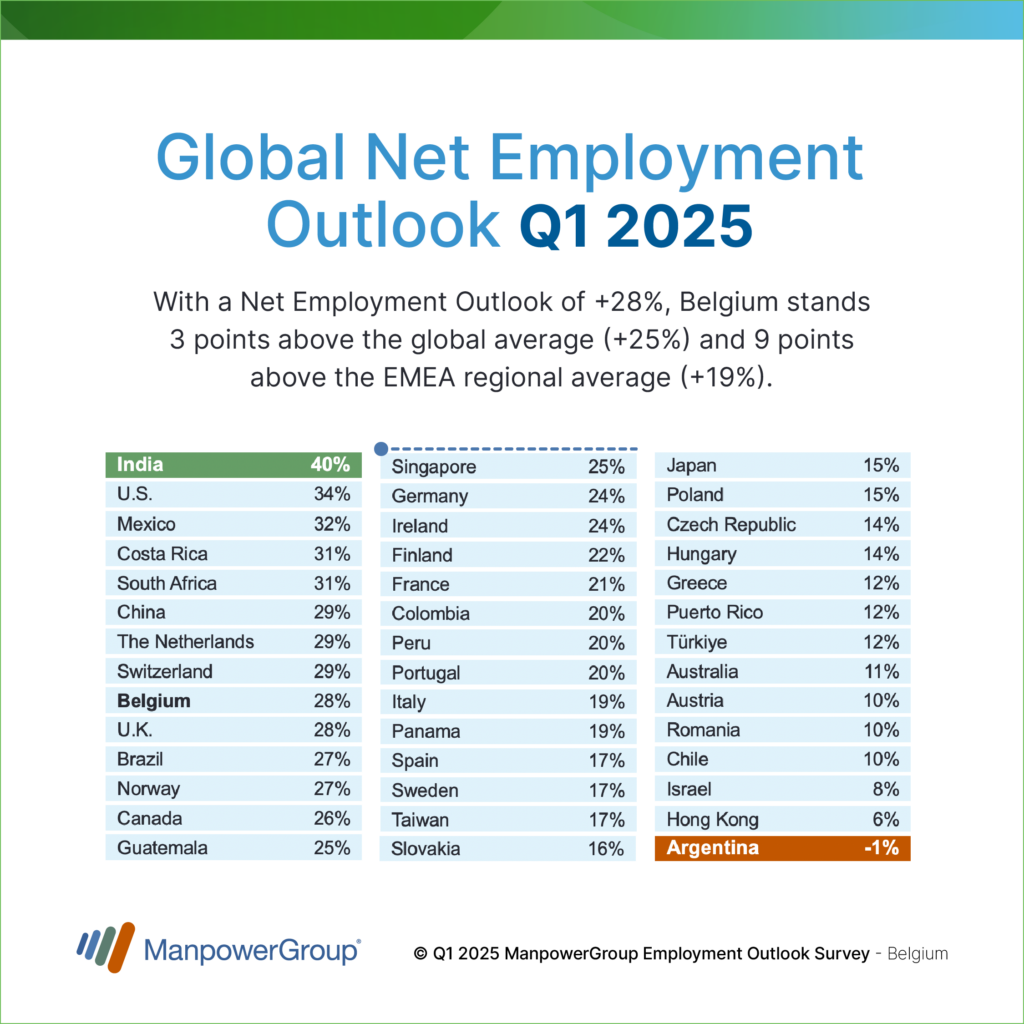

Positive employment outlooks in 41 out of 42 countries surveyed globally

The analysis of the results from ManpowerGroup’s survey of more than 40,000 employers worldwide indicates that employers have adapted to the current economic conditions by planning to maintain steady workforce planning. Employment outlooks are positive in 41 out of 42 countries surveyed, with Argentina being the only exception, showing negative recruitment intentions (-1%).

The Net Employment Outlook stands at +25%, unchanged from the previous quarter and reflecting only a 1-point decline from the same period last year. Employers in India (+40%) and the United States (+34%) are the most optimistic. Employment prospects also remain fairly favorable in China (+29%).

However, the hiring climate is more strained in the EMEA region, where the Net Employment Outlook remains at +19%, down 2 points from the previous quarter and 1 point compared to the same period last year. Recruitment intentions have declined in 14 out of 23 countries on an annual basis.

With a Net Employment Outlook of +28%, Belgium ranks third out of 21 European countries, behind the Netherlands and Switzerland (both at +29%), at the same level as the United Kingdom (+28%), but ahead of Germany (+24%), France (+21%), Italy (+19%), Spain (+17%), Poland (+15%), Austria, and Romania (both at +10%).

The results of the next ManpowerGroup Employment Outlook Survey will be released on 11 March 2025 (Quarter 2 2025).

(1) Throughout this report, we use the term “Net Employment Outlook.” This figure is derived by taking the percentage of employers anticipating an increase in hiring activity and subtracting from this the percentage of employers expecting to see a decrease in employment at their location in the next quarter. The result of this calculation is the Net Employment Outlook. The analysis is based on seasonnally adjusted data.

(2) OECD Economic Surveys : Belgium 2024

About the ManpowerGroup Employment Outlook Survey

The ManpowerGroup Employment Outlook Survey for the fourth quarter of 2024 was conducted in October 2024 by interviewing a representative sample of employers from 40,000 private companies and public organizations in 42 countries and territories around the world (including 525 in Belgium). The aim of the survey is to measure employers’ intentions to increase or decrease the number of employees in their workforce during the next quarter. All survey participants were asked the same question: “How do you anticipate total employment at your location to change in the three months to the end of March 2025 as compared to the current quarter?” It is the only forward-looking survey of its kind, unparalleled in its size, scope, longevity and area of focus. The Survey has been running for 60 years and is one of the most trusted surveys of employment activity in the world. It is considered a highly respected economic indicator.

Report : ManpowerGroup Employment Outlook Survey Q1/2025