Job market under pressure in Belgium: recruitment intentions down and talent shortages up

International Women’s Day : ‘What Women Want at Work’ – #EmbraceEquity

3 March 2023

Manpower wins HR Excellence Award ‘Best Staffing & Sourcing Company’ for the third consecutive year

29 March 2023The Net Employment Outlook declines by 5 percentage points from the previous quarter, but remains positive at +18%, while 80% of employers surveyed in Belgium by ManpowerGroup report difficulties filling vacancies.

According to the ManpowerGroup Employment Outlook Survey published today, Belgian employers plan to slow the hiring pace in Q2, 2023. Of the 510 employers surveyed by ManpowerGroup(1) at the end of January, 36% plan to increase their workforce by the end of June 2023, while 18% plan to reduce their headcount. 43% of employers surveyed anticipate no change. After adjusting for seasonal variations, the Net Employment Outlook(2) – or the difference between the percentage of employers anticipating hires and the percentage anticipating layoffs – stands at a positive +18%. This is a decrease of 5 percentage points from the previous quarter and 16 percentage points from Quarter 2 2022.

For this edition, ManpowerGroup also conducted its annual survey on talent shortages. Four out of five Belgian employers (80%) are experiencing difficulties filling their vacancies, and almost one in five (17%) say they are having great difficulty finding the right profiles. Talent shortages have increased by 4 points compared to last year (76%). Belgium is above the world average (77%) and one of the worst affected at European level (in seventh place out of 22).

“In the context of the major uncertainty that persists, the labour market remains under great pressure,” explains Sébastien Delfosse, Managing Director of ManpowerGroup BeLux. “Two realities are colliding. On the one hand, as our survey shows, structural talent shortages are increasing, jeopardising the development of our companies. On the other hand, employers have to adjust their workforce due to the continuing unfavourable economic situation and due to the indexation of salaries that they have had to integrate into their cost structure. This explains the increased caution and the decline in the Net Employment Outlook for the second quarter. However, the latest projections from the National Bank of Belgium and the European Commission indicating that Belgium is likely to narrowly avoid a recession, show that our economy continues to weather the storm, and we should be able to look forward to the second half of the year with more optimism.”

Mixed employment prospects and recruitment difficulties in the three regions

Employers in all three regions report positive hiring intentions for the upcoming quarter. In Wallonia, the hiring climate is expected to be the most favorable, with the Net Employment Outlook reaching +28%, a 10 point increase from the previous quarter. In the other two regions, employers anticipate a slower hiring pace. In Brussels, the Net Employment Outlook declines by 11 percentage points to +21%, while in Flanders, the Outlook declines by 9 percentage points to +10%, the weakest level for two years.

Since last year, it has become more difficult to recruit in all three regions, with talent shortages affecting 84% of employers in Wallonia, 80% of employers in Brussels and 76% of employers in Flanders.

The IT sector is recruiting, but struggling to find digital talent

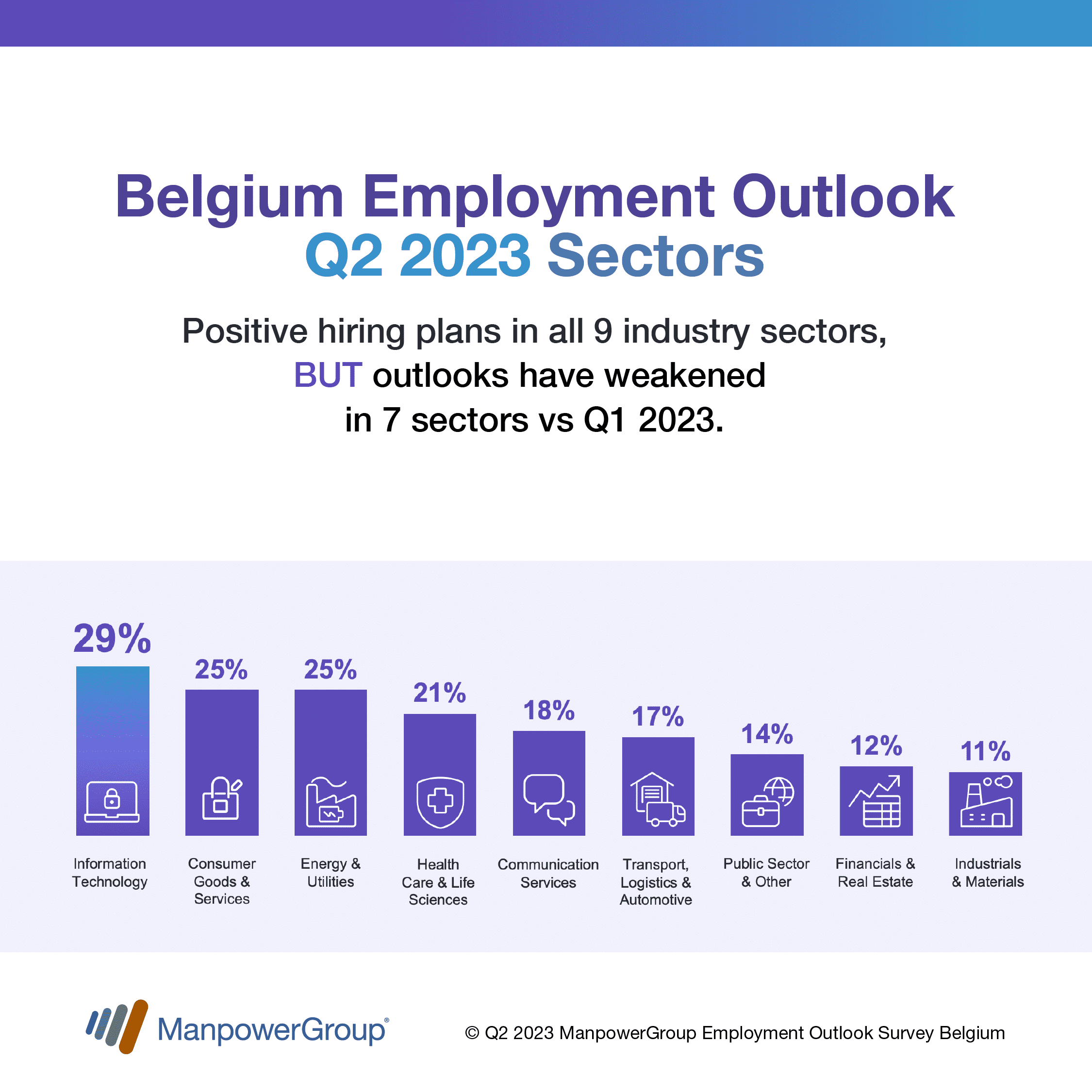

Employers in all nine industry sectors surveyed expect to create new jobs by the end of June, although seven sectors report weaker hiring plans in comparison with the previous quarter. Employers in the IT sector anticipate the strongest hiring activity (+29%), followed by employers in the Consumer Goods/Services/Hospitality/Retail sector and the Energy sector (both at 25%). Employment prospects remain relatively strong in the Healthcare/Life Sciences sector (+21%), the Communication Services sector (+18%) and the Transportation/Logistics/Automotive sector (+17%). Conversely, the weakest hiring intentions are reported by employers in the Public Services/Education/Other sector (+14%), the Finance & Real Estate sector (+12%) and the Manufacturing/Construction/Agriculture & Fishing sector (+11%).

No sector is spared from talent shortages. As was the case last year, the IT sector is where employers are experiencing the greatest recruiting difficulties. 86% of employers are struggling to find the right people on the job market. Employers in the Healthcare/Life Sciences sector and the Consumer Goods Services/Horeca/Retail sector are experiencing the same level of difficulty (86%). Labour shortages also remain severe in the Finance & Real Estate sector (82%), Public Services/Education/Other (+80%), Transportation/Logistics/Automotive (75%), Energy (75%) and Manufacturing/Construction/Agriculture & Fishing (73%). The Communication Services sector has the least difficulty (68%).

The survey also reveals that micro-companies (< 10 workers) and large companies (≥ 250 workers) have the greatest difficulty in filling their vacancies (83%).

Hard and soft skills most in demand

The ManpowerGroup survey identified the most sought-after profiles and skills, both in terms of hard skills and soft skills.

In terms of hard skills, IT profiles, engineers, logistics roles, sales & marketing profiles and technical and production roles are the most difficult to fill.

In terms of soft skills, Belgian employers are currently looking for candidates possessing the following attributes, in order of priority: responsibility/reliability/discipline, resilience/adaptability, initiative, the ability to analyse and solve problems, and learnability.

“With talent shortages affecting all sectors and almost all functions, employers need to recruit and manage their staff, focusing more on an individual’s potential, rather than on educational qualifications. This will allow them to broaden their talent pool by being more creative in the way they attract and retain talent. Today, recruiters need to rely more on candidates’ learnability and on soft skills, which are becoming increasingly important in an ever-changing environment,” concludes Sébastien Delfosse.

The results of the next ManpowerGroup Employment Outlook Survey will be released on 13 June 2023 (Quarter 3 2023).

Report ManpowerGroup Employment Outlook Survey Q2/2023