Optimism returns to the labour market: one in two Belgian employers plans to strengthen its workforce by the end of the year

Return to the Workplace: Full-time work onsite and hybrid work on an equal footing

30 June 2021

37% of Belgian companies invest in training to overcome talent shortages

6 October 2021- The Net Employment Outlook reaches its strongest level (+ 30%) since the launch of the ManpowerGroup Employment Outlook Survey in Belgium in 2003, the fifth consecutive quarterly increase.

- Employers are unable to fill their vacancies quickly enough due to talent shortages, which have reached record levels for 15 years for the second consecutive quarter, both nationally (77%) and in the three regions of the country: 83% of employers in Brussels and 75% of employers in Flanders and Wallonia are experiencing recruitment difficulties.

- After ‘jobs, jobs, jobs’, ‘training, training, training’ is becoming the new mantra in the labour market.

According to the ManpowerGroup Employment Outlook Survey released today, the recovery in the labor market is expected to accelerate significantly over the next three months in Belgium and around the world. Of the 520 Belgian employers surveyed by ManpowerGroup at the end of July(1), one in two (50%) plan to increase their workforce by the end of December 2021, while one in five (20%) plan to reduce headcount. 28% of employers surveyed are forecasting no change. After seasonal adjustment, the Net Employment Outlook(2) – the difference between the percentage of employers expecting to hire staff and the percentage of those planning to reduce staff – rises to a very optimistic value of +30%, the fifth consecutive quarterly increase. This is a spectacular increase of 16 points when compared with the previous quarter and by 29 points in comparison with the fourth quarter of 2020. This is the strongest Outlook since the survey began in 2003.

“The success of the vaccination campaign and the easing of health measures have strengthened the confidence of employers in Belgium and around the world” explains Philippe Lacroix, Managing Director of ManpowerGroup BeLux. “The Net Employment Outlook is at an all-time high in Belgium, as it is in eleven other countries surveyed. At the same time, employers are not able to fill their vacancies quickly enough due to talent shortages, which have reached record levels for 15 years for the second consecutive quarter, both nationally (77%) and in the three regions of the country: remain at very high levels in all three regions of the country: 83% of employers in Brussels and 75% of employers in Flanders and Wallonia are having difficulty finding the right talent. The results of our survey clearly indicate that we are in a ‘candidate market’ meaning businesses are competing for the best talent by implementing concrete attraction and retention strategies. A new era of work is emerging, based on the individual choices of workers who have taken back control and who expect employers to adapt to their expectations, especially the most qualified. “

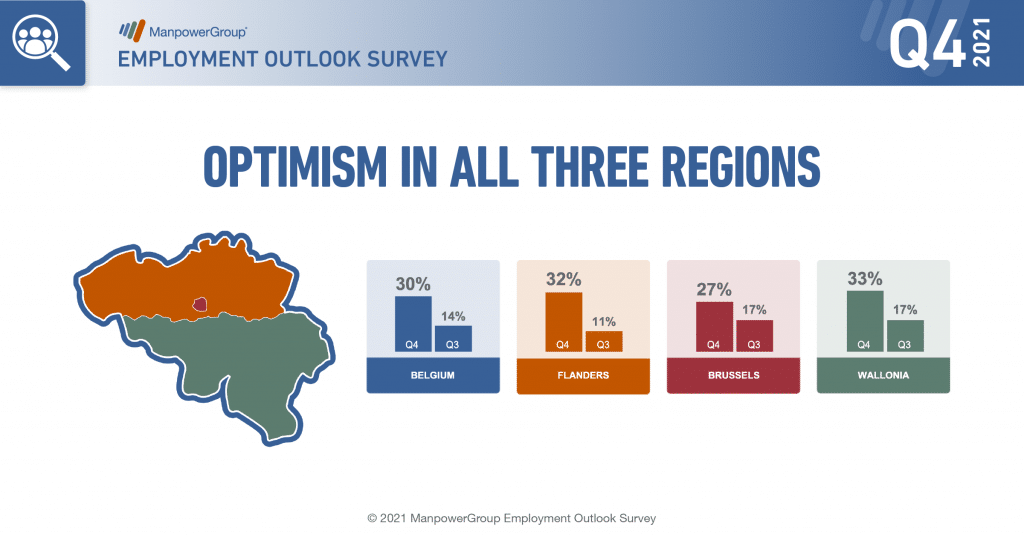

Optimism in all three regions

According to the survey results, employers in all three region anticipate strong labor markets and net employment growth over the next quarter: + 33% in Wallonia, + 32% in Flanders and + 27% in Brussels. Hiring plans are up sharply in all three regions , both in comparison with the previous quarter and with the same period last year. (2)

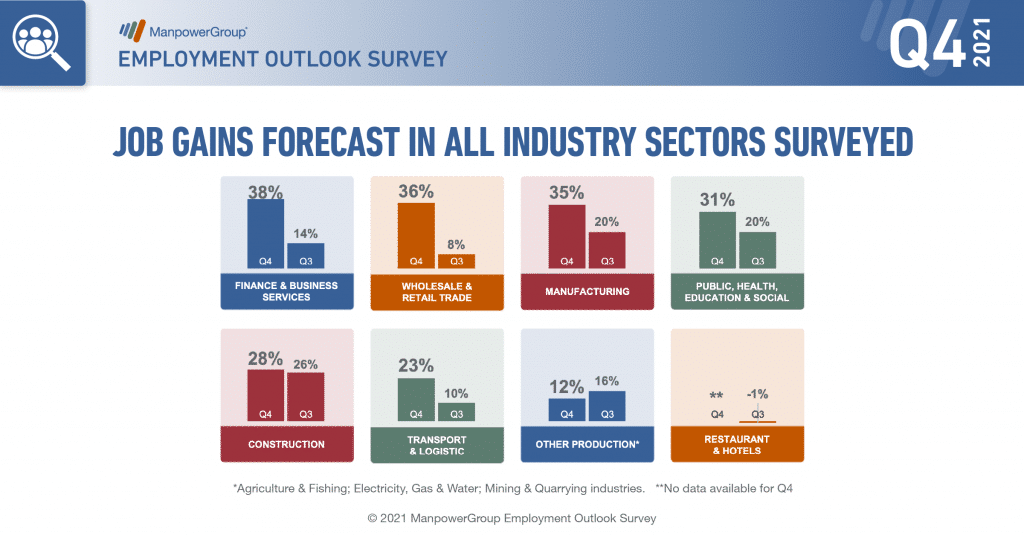

Job gains forecast in all industry sectors surveyed

Workforce gains are forecast in all seven industry sectors for which data is available(3) during the fourth quarter of 2021. Finance, insurance, real estate and business services sector employers expect the strongest hiring pace, reporting a robust Net Employment Outlook of +38%, while Outlooks stand at +36% and +35% in the Wholesale & Retail Trade sector and the Manufacturing sector, respectively. Healthy hiring activity is anticipated in the Public services, health, education and social service sector (+31%), in the Construction sector (+28%) and in the Transport and Logistic sector (+23%) . Meanwhile, the weakest labour market is expected by Other Production sector employers – Agriculture & Fishing; Electricity, Gas & Water; Mining & Quarrying industries –, reporting an Outlook of +12%.

Employer confidence increases in line with company size

According to the ManpowerGroup survey, the Net Employment Outlook shows an increasing value in line with the size of the company: +8% for Micro businesses (<10 workers), +22% for Small busineses (10-49 workers), +28% for medium-sized companies (50-249 workers) and +39% for large companies (≥ 250 workers).

‘Training, Training, Training’ to overcome talent shortages

To overcome the ongoing talent shortages that still affect 77% of Belgian employers surveyed by ManpowerGroup – a figure down 6 points compared to the previous quarter but still a 15-year high for the second consecutive quarter – companies are having to be creative filling their vacancies. 37% of organizations are investing in training, skills development and mentoring, while 72% of them say they want to offer greater flexibility, both in terms of working hours (41%) and location (31% ) – teleworking or work in satellite locations. 30% of employers are willing to improve salary conditions to help attract talent, compared to 23% offering non-financial benefits such as time off. Finally, 19% say they are prepared to reduce their job skills or experience requirements when recruiting and 10% will be ready to eliminate job screening.

Training is emerging as the top short-term priority for HR departments and many companies are preparing to launch new training intiatives in the next six months. Indeed, 30% of employers surveyed plan to launch new technical training programs, 26% plan to increase management skills, 25% of them plan to offer new training to improve soft skills (communication, time management, etc.) while 22% of them will initiate one-on-one career coaching programmes to address the lack of available talent.

The ManpowerGroup survey shows that all talent pools should receive attention in the area of reskilling or upskilling, whether they be young graduates (38%), low skilled staff (38% ), highly qualified staff (37%) or workers over 50 years old (22%).

As more employers’ plan to upskill workers, money (22%), time (22%) and lack of knowledge or access to the right training partners (13%) were cited as the biggest obstacles facing businesses.

“In a world that is changing ever more rapidly, that is becoming automated, digitalized and becoming virtual, skills are under more pressure than ever and threatened with obsolescence. Therefore, after the ‘Jobs, Jobs, Jobs’, ‘Training, Training, Training’ is becoming the new mantra on the job market,” adds Philippe Lacroix.

Record employment prospects together with worldwide talent shortages

ManpowerGroup interviewed more than 44,000 employers around the world on hiring intentions for the fourth quarter of 2021.

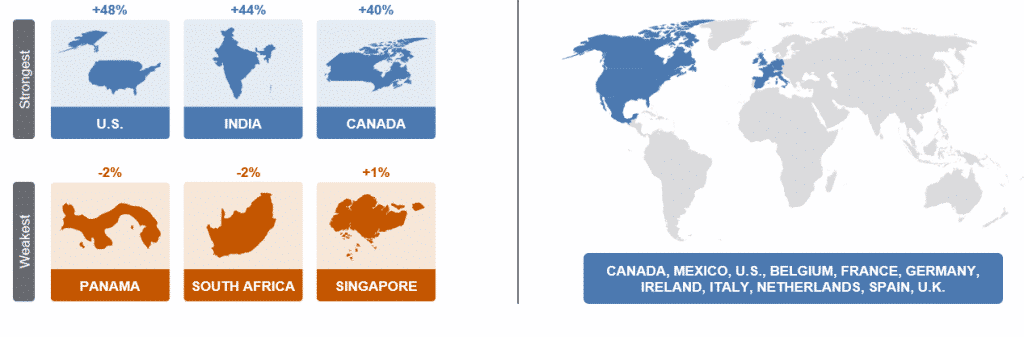

Employers anticipate payroll gains in 41 of the 43 countries and report stronger hiring plans in 31 countries in comparison with the previous quarter. This encouraging trend is also observed in the EMEA region (Europe, Middle East, Africa), with positive recruitment intentions in 25 of the 26 countries surveyed, improving in 20 of them on a quarterly basis.

Highlight: Hiring outlooks reach survey record levels for 11 out of 43 markets – United States (+48%), Canada (+40%), Netherlands (+40%), Mexico (+39%), France (+37%), Ireland (+34%), Spain (+32%), United Kingdom (+32%), Belgium (+30%), Germany (+28%) and Italy (+28%). Employment prospects are also very optimistic in India (+44%), while they are more modest in Japan (+16%), Brazil (+14%), China (+12%) and Australia (+12%).

As in Belgium, the encouraging employment outlook is accompanied by a 18 year high in talent shortages for the second consecutive quarter, affecting 69% of employers worldwide (unchanged from the previous quarter), and 73% of employers in the EMEA region (down 1 point from the previous quarter).

The results of the next ManpowerGroup Employment Outlook Survey will be released on 14th December 2021 and will report hiring expectations for Q1 2022.

(1) The methodology used to collect the data for the Employment Outlook changed for [Q4 2021 / Q1 2022]. Respondents in prior quarters were contacted via telephone. With the shift to remote working and much higher reliance on the internet, survey responses are now being collected online. Respondents are members of double opt-in online panels and are incentivized to complete the survey. The question asked and the respondent profile remains unchanged. Size of organization and sector are standardized across all countries to allow international comparisons

(2) Throughout this report, we use the term “Net Employment Outlook.” This figure is derived by taking the percentage of employers anticipating an increase in hiring activity and subtracting from this the percentage of employers expecting to see a decrease in employment at their location in the next quarter. The result of this calculation is the Net Employment Outlook. Net Employment Outlooks for countries and territories that have accumulated at least 17 quarters of data are reported in a seasonally adjusted format unless otherwise stated. Seasonally adjusted data are not available for Croatia.

(2) Separate analysis of the Restaurants & Hotels sector is not available for the fourth quarter of 2021.