Economic Uncertainties Continue to Impact Employers’ Hiring Plans in Belgium

ManpowerGroup Named One of the World’s Most Sustainable Companies by TIME Magazine

24 July 2024

Belgium drops two places in ManpowerGroup’s 2024 Total Workforce Index™ and ranks 52nd out of 64

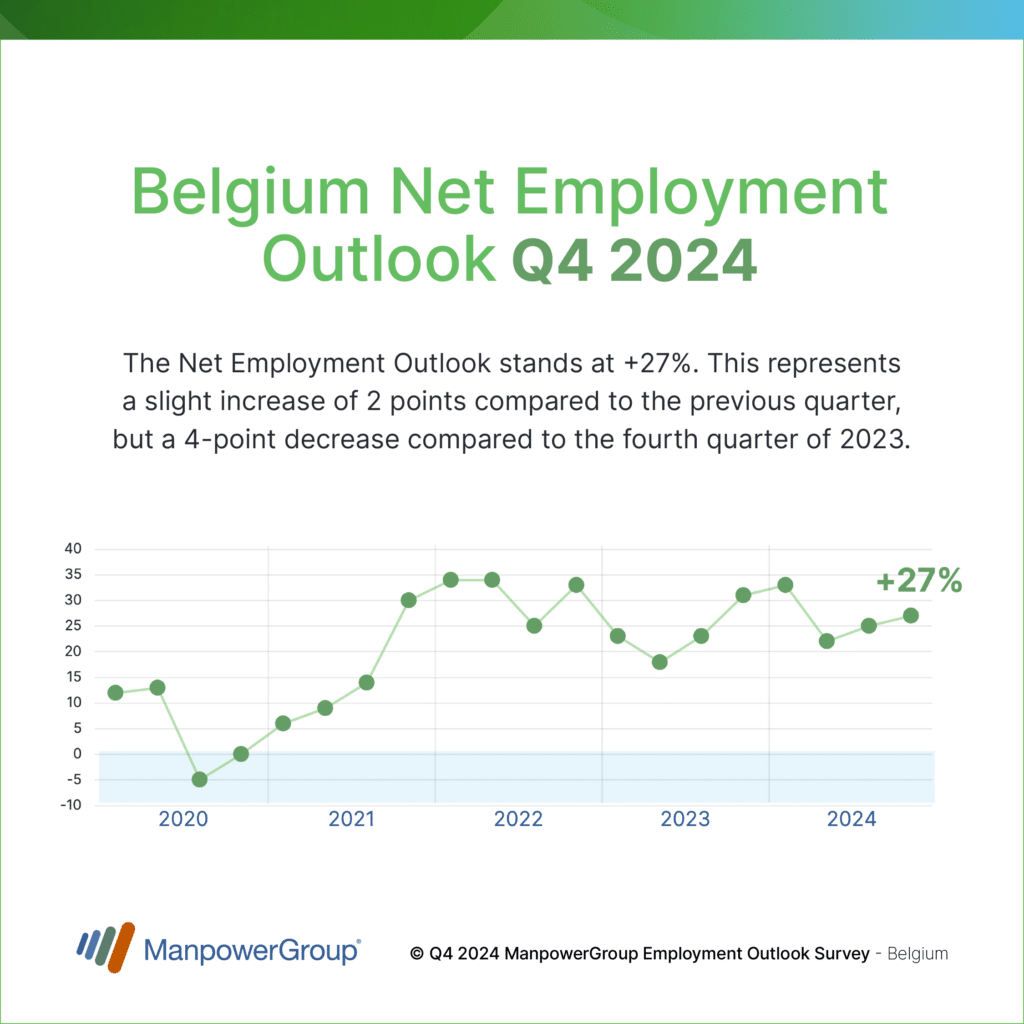

16 September 2024The ManpowerGroup Employment Outlook Survey for the fourth quarter of 2024 shows signs of improvement on a quarterly basis (up 2%). However, the Net Employment Outlook for Belgium remains lower compared to the same period last year (down 4%) and stands at +27%.

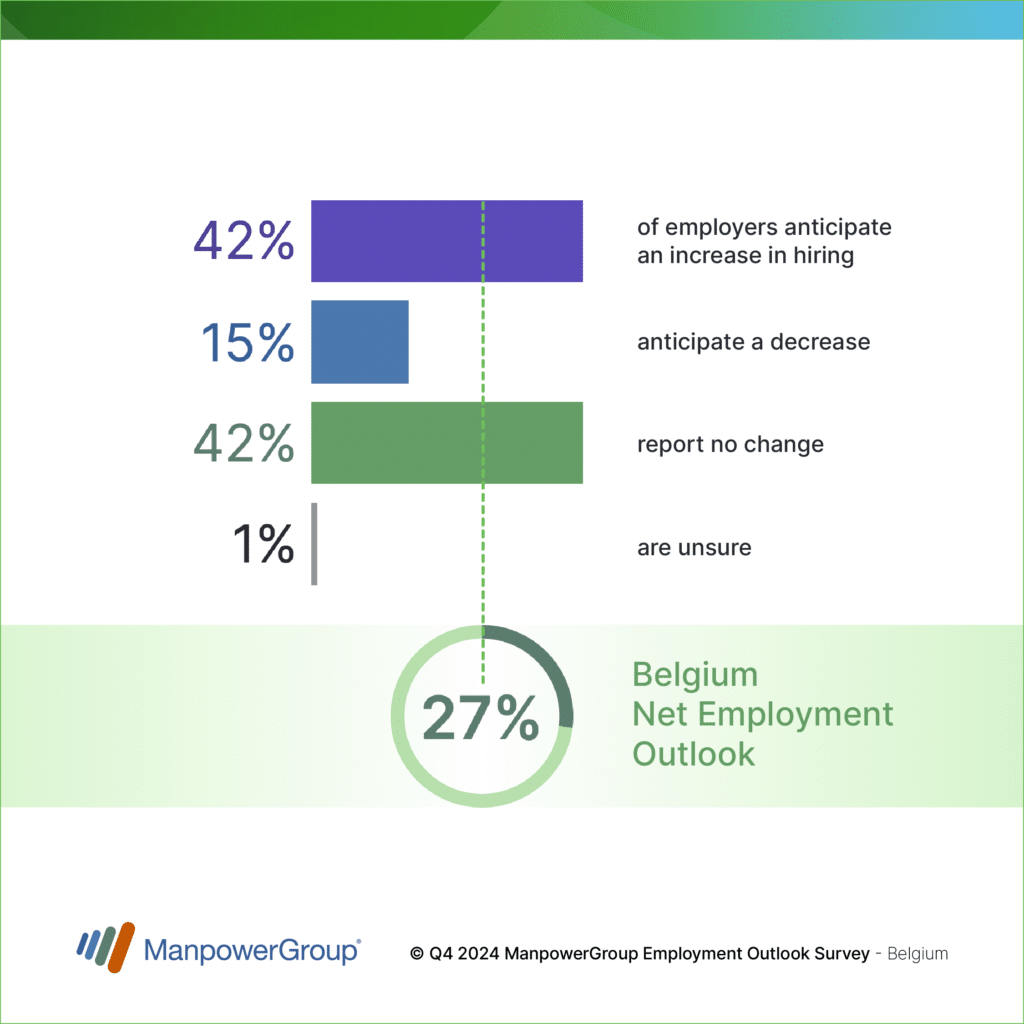

According to the ManpowerGroup Employment Outlook Survey released today, Belgian employers anticipate positive hiring activity for the upcoming quarter. Of the 530 employers surveyed by ManpowerGroup in July, 42% plan to increase their workforce by the end of December 2024, while 15% plan to reduce it. Additionally, 42% of the employers surveyed expect no change. After seasonal adjustment, the Net Employment Outlook – the difference between the percentage of employers planning to hire and those expecting to reduce their workforce – stands at +27%. This represents a slight increase of 2 points compared to the previous quarter, but a 4-point decrease compared to the fourth quarter of 2023.

“The results of our Employment Survey indicate that Belgian employers plan to continue creating jobs in the fourth quarter of 2024,” says Sébastien Delfosse, Managing Director of ManpowerGroup BeLux. “Despite a rise in the Net Employment Outlook for the second consecutive quarter, employers are less confident than they were during the same period last year, due to ongoing economic uncertainties. They are forced to adapt by focusing on securing and acquiring the talent they need to drive their transformation and growth. The job market remains under pressure globally. In fact, according to the data collected from 40,000 employers around the word, hiring intentions are down compared to last year in 30 of the 42 countries surveyed globally, and in 15 of the 23 countries in the EMEA region.”

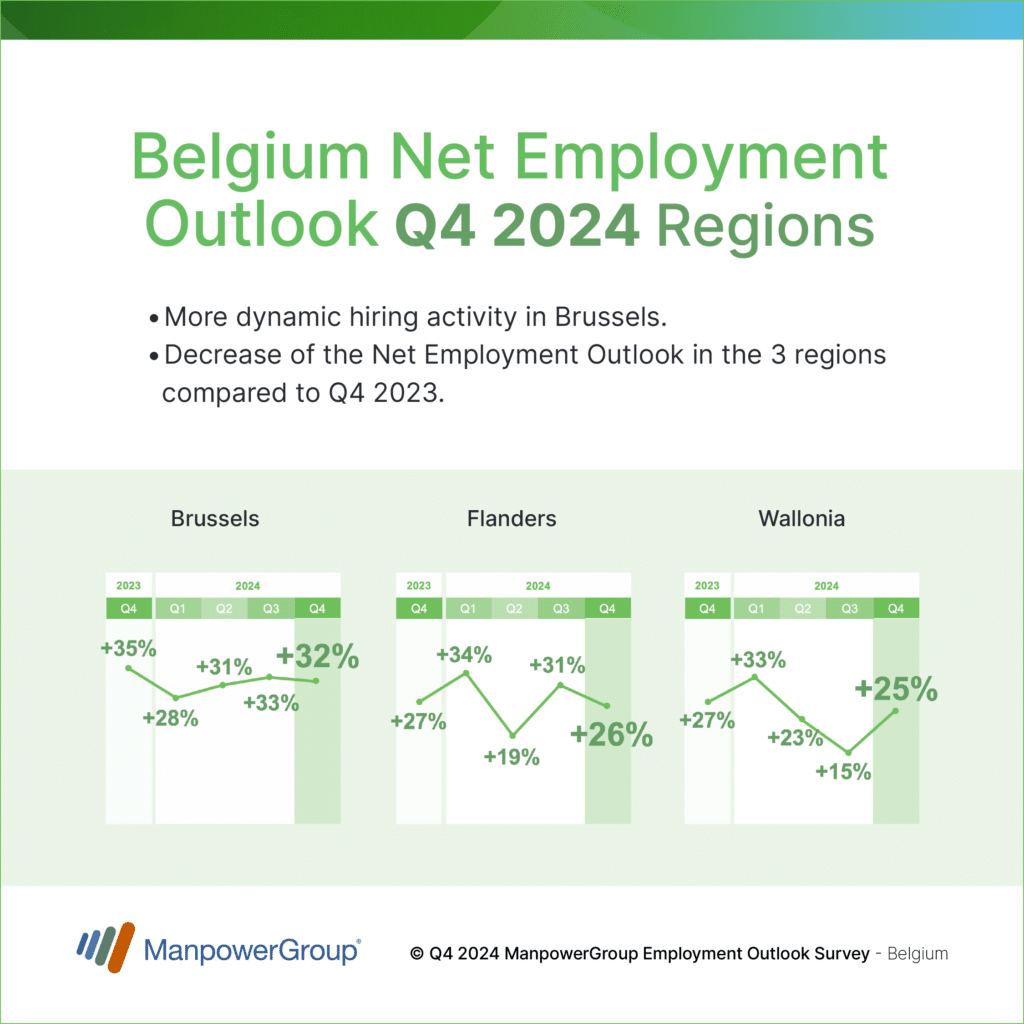

More dynamic hiring activity in Brussels

Employment prospects remain positive in all three regions of the country, with more dynamic hiring activity in Brussels (+32%), followed by Flanders (+26%) and Wallonia (+25%). However, a slowdown in hiring is expected in all three regions compared to the same period last year.

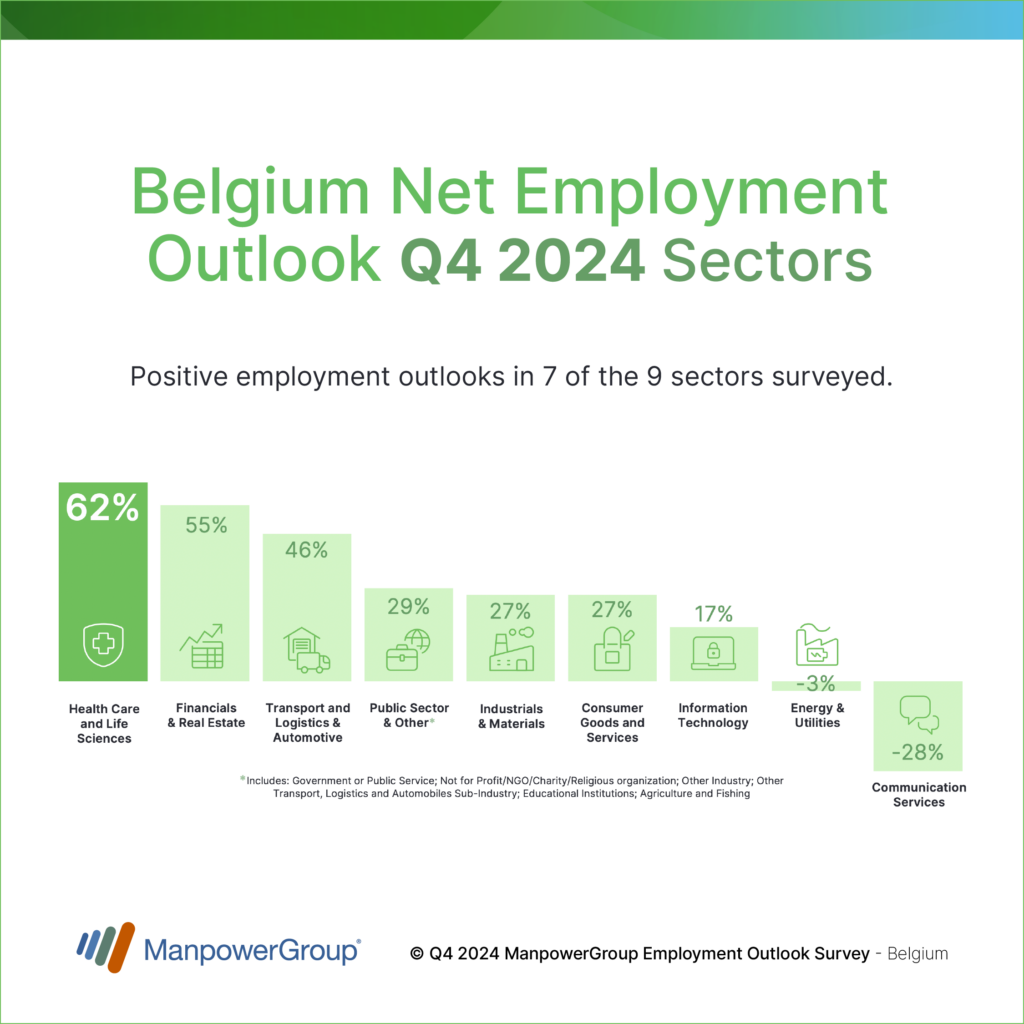

Positive employment outlooks in 7 of the 9 surveyed sectors

Employers in 7 of the 9 sectors surveyed in Belgium plan to increase their workforce by the end of December 2024.

Employers in the Healthcare and Life Sciences sector report the strongest intentions at a record level of +62%, with more than 7 out of 10 surveyed employers planning to increase their workforce by the end of the year. Hiring activity is also expected to be particularly strong in the Financial Activities and Real Estate sector (+55%), as well as in the Transport, Logistics, and Automotive sector (+46%). The Net Employment Outlooks in the Manufacturing/ Construction/Agriculture&Fishing sector and Consumer Goods and Services stand at the same level as the national average (both at +27%).

Conversely, employment prospects are negative in the Energy & Utilities sector (-3%) and the Telecommunications/Media/Communication Services sector (-28%).

Contrasting hiring intentions by company size

In terms of business segments, hiring activity is expected to be most favorable in companies employing more than 5,000 workers globally (+51%), while companies employing fewer than 10 workers report the lowest and only negative Net Employment Outlook (-9%). “These two figures illustrate the driving role that scale plays in current labor markets, but also the vulnerability of small businesses in an economically challenging environment like the one we are experiencing today,” adds Sébastien Delfosse.

Global job market under pressure

The analysis of the survey results conducted by ManpowerGroup among more than 40,000 employers worldwide indicates a decline in the Net Employment Outlook on an annual basis in 30 of the 42 countries surveyed globally and in 15 of the 23 countries in the EMEA region (Europe, Middle East, Africa). Nevertheless, employment prospects remain positive in all the countries surveyed. The Net Employment Outlook stands at +25%, a slight increase of 3 points compared to the previous quarter, but a decrease of 5 points compared to the fourth quarter of 2024. Employers in India (+37%), Costa Rica (+36%), and the United States (+34%) are the most optimistic, while their counterparts in Israel (+8%) and Argentina (+4%) are the most pessimistic.

With a Net Employment Outlook of +27%, Belgium is 2 points above the global average (+25%) and 6 points above the EMEA regional average (+21%). Belgium ranks fifth out of 21 in Europe, behind Switzerland (+32%), Ireland (+30%), the Netherlands (+30%), and the United Kingdom (+28%), but ahead of several countries including France (+22%), Germany (+22%), Spain (+20%), Italy (+19%), Poland (+15%), Sweden (+13%), and the Czech Republic (+11%).

Elsewhere in the world, employment prospects have declined on an annual basis in the United States (+34%), Brazil (+32%), and China (+28%), while they have slightly increased, but remain at a very low level in Japan (+12%).

The results of the next ManpowerGroup Employment Outlook Survey will be released on 10 December 2024 (Quarter 1 2025).

(1) Throughout this report, we use the term “Net Employment Outlook.” This figure is derived by taking the percentage of employers anticipating an increase in hiring activity and subtracting from this the percentage of employers expecting to see a decrease in employment at their location in the next quarter. The result of this calculation is the Net Employment Outlook. The analysis is based on seasonnally adjusted data.

Report : ManpowerGroup Employment Outlooks Survey Q4/2024